הפנייה לאתר דה מרקר כתבה על פועלו של נתנאל סמריק

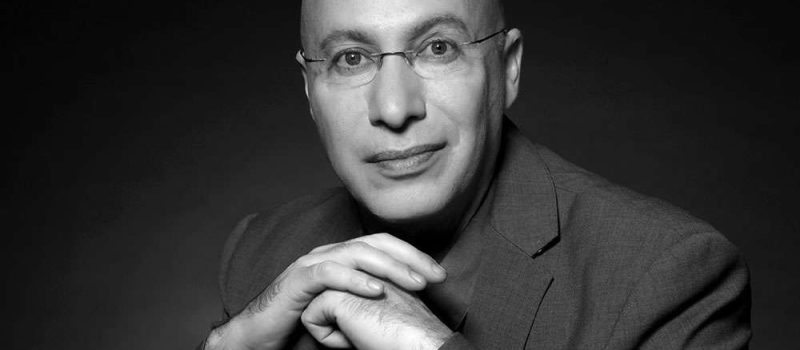

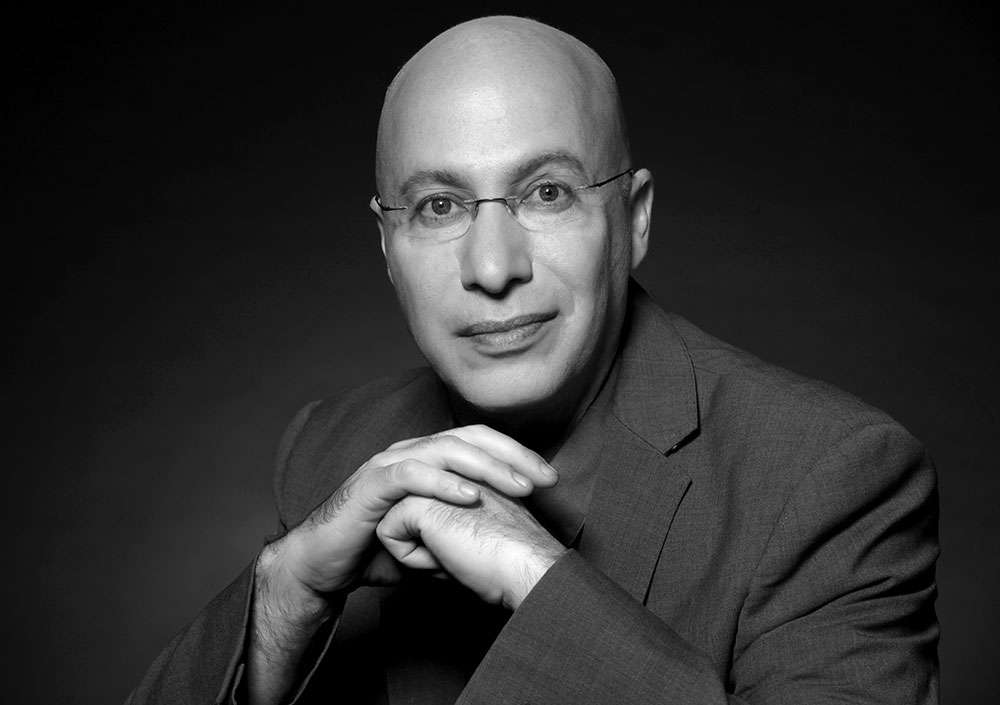

קונטנטו דה סמריק בהגשת נתנאל סמריק : ראיונות עם חתני פרס ישראל וסיפוריהם ששודרו באולפני החברה

קונטנטו דה סמריק, ארחה באולפני הטלוויזיה שלה שורה ארוכה של חתני פרס ישראל בסיפורים מרגשים במיוחד. נתנאל סמריק, המראיין היום באולפני הדיגיטל החדישים של קונטנטו נאו, נזכר ברגעי המהפך בחייהם של האישים שמדינת ישראל הכתירה כמובילים בתחומם.